How Does Home Loan Tenure Work?

Tenure of a home loan is the total period being arrived for completely repaying the principal & interest. Typical Home Loan tenure range between 1 year & 25 years.

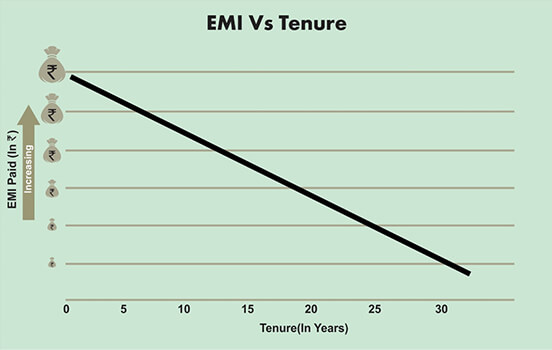

Tenure is inversely proportional to the EMI; Higher the tenure – lower the EMI and Vice versa

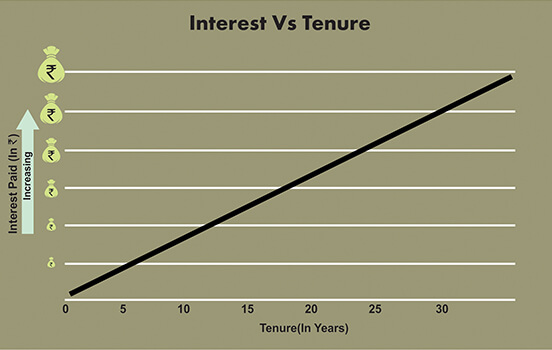

Tenure is directly proportional to the total Interest paid in a loan; Higher the tenure – higher the Interest payable

How to choose a right tenure:

Longer tenures give relief on monthly cash outflows but a higher overall interest amount payable. It is wise to choose a tenure that perfectly balance the monthly payable vis-a-vis total interest payable.

It’s wise to measure & assess current monthly income level, project a conservative/realistic rise in monthly income in 2-3 future time

horizon and basis that decide on a balanced tenure as afore-mentioned, which gives the affordable EMI outflow post the repayment eventually starting.

Below graph depicts the relationship between tenure and EMI/Interest payable of a loan