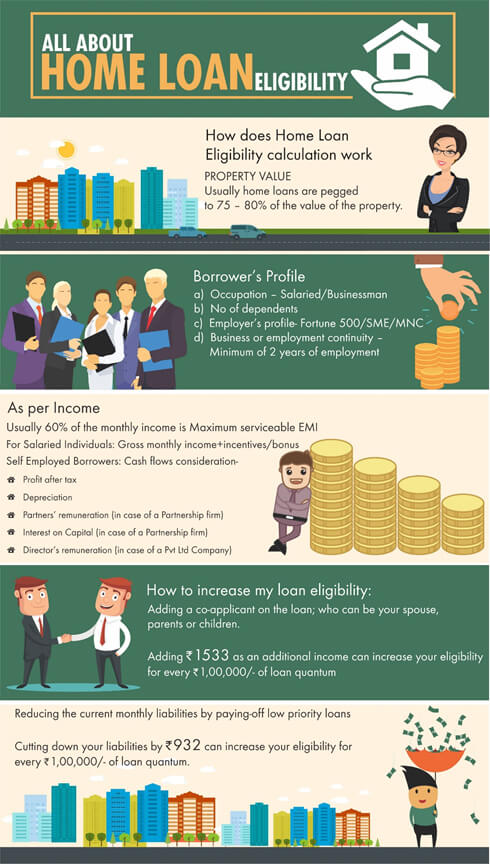

How Does Eligibility Calculation Work?

Loan Eligibility is a factor of the following criteria:

Property Value – Usually home loans are pegged to 75 – 80% of the value of the property, as determined by the lender.

Borrower’s Profile – The key aspects that come into play are:

As per Income – Usually banks cap the Maximum serviceable EMI of a prospective Home loan to 50 – 60% of the Gross Monthly income. In case of self-employed borrowers, the banks look at the cash flows generated from the business such as:

How to increase my loan eligibility:

Adding a co-applicant on the loan; who can be your spouse, parents or children.

For every Rs.1,00,000/- of loan quantum at a 20-year tenure & 9.50% Interest rate, it takes about Rs.1533/- of additional income.

Reducing the current monthly liabilities by paying-off low priority loans

Here’s a simple calculator that shows what happens to your home loan eligibility if you cut out an existing EMIs of any other loan type